37+ How much can i borrow first home loan

The par yields are derived from input market prices. Eligible first home buyers can use the First Home Loan Deposit Scheme to avoid LMI completely.

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

The first number 29 represents your housing expense ratio.

. Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate. Calculate How Much Home You Can Afford to Buy Given Your Current Income Debts. A down payment is a type of payment made in cash during the onset of the purchase of an expensive good or service.

For example in 2010 the tax rate that applied to the first 17000 in taxable income for a couple filing jointly was 10. And you can also borrow the LMI premium by folding into your loan. 40000 to less than 100000.

We still need to add in a few other taxes. How much loan could I borrow. We can handle your term paper dissertation a research proposal or an essay on any topic.

You can also complete our pre-qualify form to find out if you can borrow the amount you want. January 30 2022 at 128 pm. You can apply for a Home Loan at any time once you have decided to purchase or construct a property even if you have not selected the property or the construction has not commenced.

The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. Everything you need to know about student loans. Rommel mars marquez.

IRS Tax Refund Calendar. Daily Treasury PAR Yield Curve Rates This par yield curve which relates the par yield on a security to its time to maturity is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. How much extra can I borrow.

SCO NO 247-248 FIRST FLOOR SECTOR 12 OPPOSITE MINI SECRETARIAT KARNAL HARYANA - 132001. If this is also happening to you you can message us at course help online. We will ensure we give you a high quality content that will give you a good grade.

If youre looking into how much home you can afford just enter your location yearly income monthly debts and how much money you have for a down payment and closing costs. What Are PLUS Loans. The pound fell to a 37-year low while the cost of insuring against a UK government debt default rose on the first full day of.

First we need to consider how much you pay in FICA taxes which go to Social Security 62 and Medicare 145. The lowest home loan rate of 314 pa comparison rate 306 pa can be found with Unloans Variable Rate Home Loan Refinance Only home loan. 10000 or half your vested account.

The payment typically represents only a percentage of the full. Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator. PAG-IBIG SALARY LOAN - Here is a guide on how much you can borrow under the Pag-IBIG Fund salary loan offer based on members contribution.

The first option for using a 401k to purchase a home is borrowing from your account. The costs of some federal credit and loan programs according to provisions of the Federal Credit Reform. The first two have limits on how much can be borrowed while direct PLUS loans have no limit.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. This loan is repaid either on the sale of the property or the end of the mortgage term whichever comes first. See Developer Notice on February 2022 changes to XML data feeds.

For their maximum front- and back-end ratios and other factors that consider to determine how much you qualify to borrow. Its a flat fee so that people can afford any necessary medicine regardless of cost. The piggyback second mortgage can also be financed through an 8020 loan structure.

You can borrow the lesser of either. The loan is secured on the borrowers property through a process. Get advice on how to pay for college without drowning in debt.

Owner Occupied loans. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Tanung q lang po kung magkano n po nahuhulog q dun sa first loan q.

Considering a mortgage for your first home and looking to see our mortgage rates. Whenever students face academic hardships they tend to run to online essay help companies. The aim of the prescription system is simple.

Borrow from the bank at a real interest rate of. The scammer contacts the victim to interest them in a work-from-home opportunity or asks them to cash a cheque or money order that for some reason cannot be redeemed locally. Borrow from her 401k at an interest rate of 4.

You can borrow the lesser of either. Prime minister will borrow more to cap costs until next election. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP.

This is calculated by dividing your mortgage payment principal interest real estate taxes homeowners. Authorization bills are also useful when giving a federal agency the right to borrow money sign contracts or. Victims can be enticed to borrow or embezzle money to pay the advance fees believing that they will shortly be paid a much larger sum and be able to refund what.

Georgia Brown Content updated on 05 Sep 2022. Subsidized direct loans to undergraduates max out at 23000. Can I borrow even with low net take home pay.

An MMM-Recommended Bonus as of August 2021. The AMP First Home Loan is a special offer only available to AMP shareholders AMP employees Resolution Life Australasia employees and is also available to other client. Online Loan Companies To Borrow From Home.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. In particular loan programs from the. While prescriptions are free in the rest of the UK they cost 935 per item in England.

1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and student.

Renting Vs Owning A Home Buying First Home Real Estate Tips Home Buying Tips

4id0gevyyh2ylm

Get Home Loan In California Rcd Capital In 2022 Home Loans Refinance Loans Loan

Tables To Calculate Loan Amortization Schedule Free Business Templates

Steps To Buying A House Home Buying Tips Home Buying Buying First Home

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

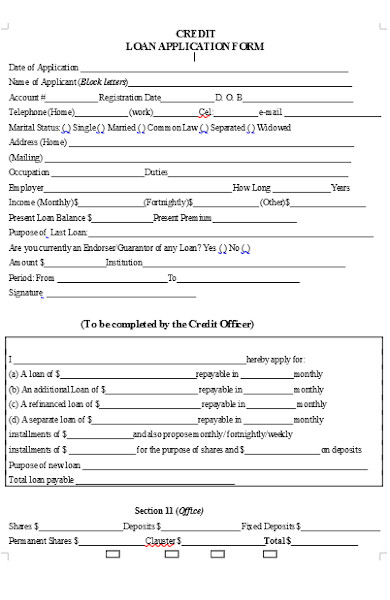

Free 55 Loan Forms In Pdf Ms Word Excel

Are Some Financial Advisors Correct When They Say That Reverse Mortgages Are In General A Bad Idea Quora

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

5 Good Bad Habits Of A First Home Buyer First Home Buyer Buying First Home Buying Your First Home

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Anz 2 68 Fixed 2yr Home Loan Up To 3500 Refinance Rebate 0 3 Bundle Rebate Home Loans Investment Advice First Home Buyer

Tips For First Time Home Buyers Applying For A Mortgage In 2022 Successful Business Tips Real Estate Quotes Home Buying Tips

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

30 Creative Financial Services Ad Examples For Your Inspiration Home Loans Banks Advertising Mortgage Loans

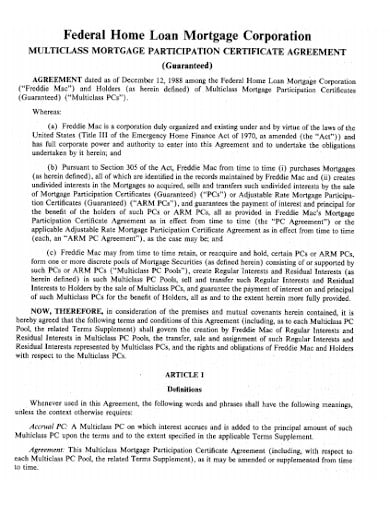

11 Mortgage Agreement Templates In Pdf Doc Free Premium Templates